The Ethnic Diversity Challenge for FTSE Boards

The target of having at least one ethnic minority board director, and to report on this, is a significant challenge for FTSE companies – especially those with smaller boards in the FTSE 250 and SmallCap Indexes.

144 FTSE All-Share companies have disclosed, in their Annual Reports, that they did not meet this target. Another 116 companies are yet to report on it, and many of those will also have missed the target.

The Target

Each FTSE company is now required to “comply or explain” in its Annual Report if “at least one director on its board is from an ethnic minority background”.

The target, initially proposed in the 2017 Parker Review, was for FTSE 100 companies to have at least one “director of colour” by 2021, and for FTSE 250 companies to do so by 2024.

However the FCA Listing Rules have extended this to all UK incorporated listed companies, as well as foreign incorporated companies with a premium listing – this covers all FTSE 100, 250 and SmallCap companies.

The reporting obligation applies to Annual Reports covering accounting periods starting on or after 1 April 2022 – so normally for accounting periods ending on 31 March 2023 or later. Many FTSE companies had already voluntarily reported on board ethnic diversity in earlier Annual Reports.

The target date for many FTSE 250 companies has effectively shifted from 2024 to the end of their accounting period in 2023. For SmallCap companies, board ethnic diversity is a new board governance target.

It should be noted that the ethnic background of each director is determined by self-identification, and is voluntary. Companies are not obliged to identify the ethnic group of individual directors – only to report the total numbers in each ethnic group.

Key Findings

We have collected and analysed the board ethnic diversity disclosures (voluntary and compulsory) in the most recent Annual Report of all FTSE All-Share Index companies. The data, now offered in our Numerable board intelligence platform, shows that a significant proportion of those companies were, at the end of that accounting period, yet to meet the target.

These findings were valid on 7th August 2023 and relate to the 576 companies in the FTSE All-Share Index on that date. This index is made up of the companies in the FTSE 100, 250 and SmallCap Indexes.

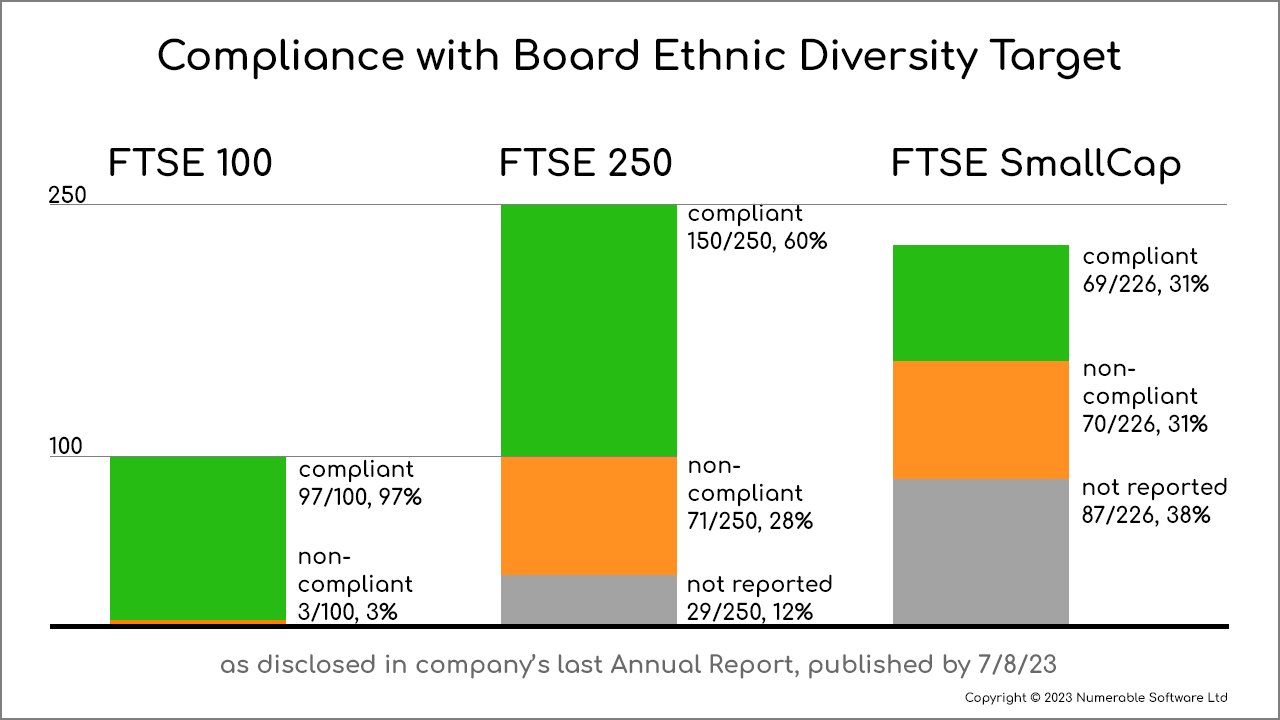

- 460 (79.9%) FTSE companies have now reported if they comply with the ethnic minority target. 116 companies have not yet reported on the target. 3 companies that were obliged to report on a compulsory basis appear to have failed to do so.

- 144 (31.3%) of the FTSE companies that have reported have failed to meet the target. 316 (68.7%) of them have met the target.

- If we assume that the proportion of compliant companies among those that have not yet reported is the same as for those that have, in each index, then we can estimate that the total number of non-compliant FTSE companies would be 197.

- 46 (10.0%) of the companies that reported have identified which of their directors are from an ethnic minority; the large majority have not, presumably to respect the privacy of their directors.

Analysis by Index

FTSE 100 – All FTSE 100 companies have now reported against the target, and only 3 failed to comply. This high level of compliance is likely to be because:

- The original Parker Review target was for FTSE 100 companies to have an ethnic minority director by 2021.

- FTSE 100 boards are usually larger (average size 10.5 directors) than those in the other indexes (FTSE 250: 7.6, SmallCap: 6.0), so “natural” retirements occur more frequently, and the addition or change of a single director represents a smaller proportion of the board.

- FTSE 100 companies place a high priority on governance targets.

FTSE 250 – 88% of FTSE 250 companies have now reported their board ethnic diversity

- More than ⅔ (67.9%) of those that have reported are compliant with the target.

- 71 companies (32.1%) have reported that they are non-compliant. 29 are yet to report.

- Between 71 and 100 FTSE 250 companies are likely to be seeking an ethnic minority director in order to comply.

FTSE SmallCap – Only 62% of SmallCap companies have so far reported on their board ethnic diversity. This may be because many of them have not voluntarily reported as they were outside the scope of the original Parker Review target.

- Of those that have reported, just half comply with the ethnic minority target – a substantially lower proportion than for FTSE 100 and 250 companies.

- Between 70 and 157 SmallCap companies are likely to be trying to recruit an ethnic minority director.

- However the small average board size (6.0 directors) of SmallCap companies means that normal retirements of directors are infrequent – one every year and 3 months on average.

The Challenge for Foreign Companies

Companies incorporated in certain jurisdictions require some directors to be resident in that jurisdiction. This creates an additional hurdle for achieving fully compliant board composition.

For example, the 22 FTSE companies incorporated in Jersey should have boards with at least:

- 40% female directors

- 1 ethnic minority director

- 2 Jersey resident directors

12 of these Jersey companies are investment trusts or funds, with small boards of 4-7 directors. So far, only one of those has reported that its board has an ethnic minority director. Several have commented in their Annual Reports that the ethnic mix in Jersey is different to that in the UK, so there are few suitable ethnic minority directors resident in Jersey.

Conclusions

This analysis highlights the challenge that many FTSE companies have in meeting the ethnic diversity target, as well as other board composition targets.

This theme is likely to influence board succession planning and recruiting for the coming years, resulting in a high demand for ethnic minority directors with the necessary skills and experience.

We will continue to monitor this topic using Numerable’s live data on the disclosures of FTSE companies. The system identifies which companies are still to recruit an ethnic minority director, as well as those failing to meet gender diversity and other board composition targets.

____________________________________________________

Numerable is an innovative board intelligence platform with a database of LSE listed public companies, directors, appointments, and associated governance and diversity metrics. It continuously collects and harmonises published information from company registries, annual reports, websites and news releases. It has a range of powerful, interactive tools to browse, search, filter, sort and analyse.